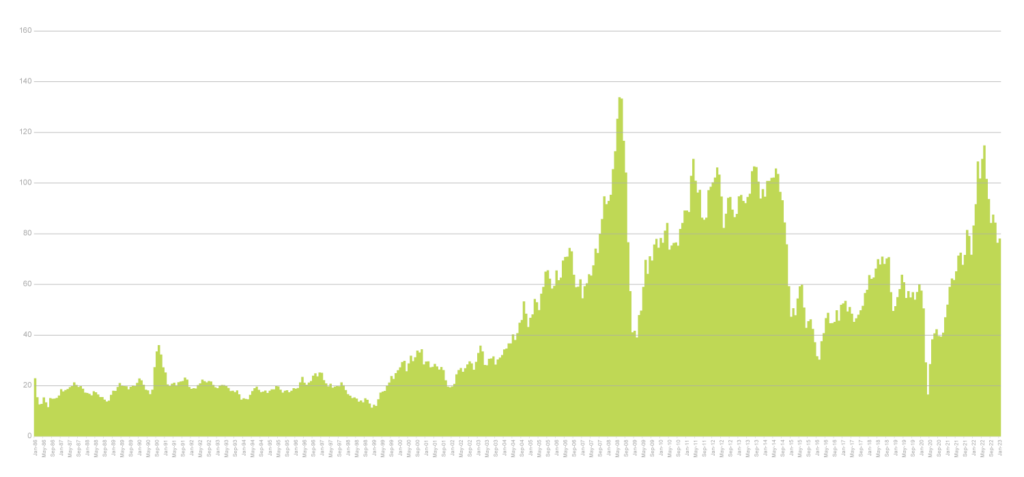

Oil prices have been volatile since 1980 and have experienced numerous spikes and drops. In the 1980s, oil prices reached an all-time high due to the Iranian Revolution and the Gulf War. The price of oil exceeded $140’s per barrel in 2008 due to increased demand from China and India, and the decline of the US dollar.

After the 2008 financial crisis, oil prices declined, reaching a low of $20’s per barrel in 2016 due to a global oversupply of oil. However, prices started to rise again in 2017 due to production cuts by OPEC and a strong global economy.

In 2018, oil prices exceeded $75 per barrel due to increased geopolitical tensions, supply cuts, and economic growth. However, prices fell again in late 2018 due to increasing concerns over a global economic slowdown and rising US oil production.

In 2020, the COVID-19 pandemic caused a global drop in demand for oil, leading to a steep decline in oil prices. The price of oil reached a low of negative $37 per barrel in April 2020 due to a surplus of oil and a lack of storage space.

Since 2020, oil prices have recovered somewhat, with prices hovering around $60 per barrel in 2021 due to the ongoing COVID-19 pandemic and increasing demand from China. However, prices are expected to remain volatile in the coming years due to factors such as geopolitical tensions, changes in global oil production, and economic conditions.

In recent years, the global oil market has been impacted significantly by COVID-19 disruptions, price wars between oil-producing nations and now the Russia / Ukraine war.

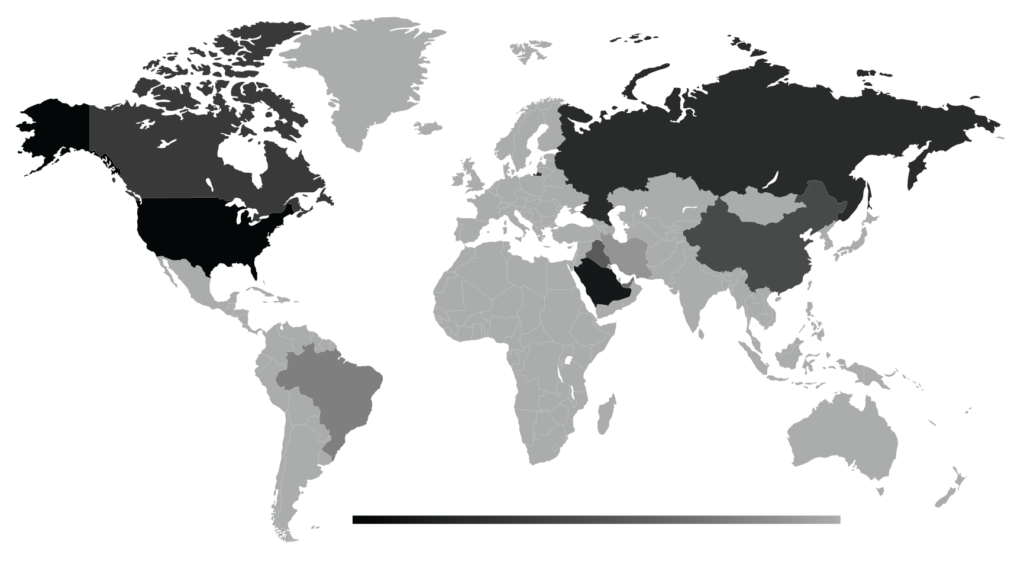

The output control deal made between the Organization of the Petroleum Exporting Countries (OPEC) and 11 of the world’s top oil producers expired in 2020. When production rose dramatically in April of that year after Russia’s decision not to approve further cuts proposed by Saudi Arabia, the de facto OPEC leader responded by offering its product at a discount and producing more oil. The top ten countries for oil production are dominated by the USA, Saudi Arabia, and Russia:

In an oversupplied market suffering from a lack of demand, oil prices turned negative, shocking market participants. Finally, with some pressure from the US, Russia and OPEC finally came to an agreement to cut production by 9.7 million barrels per day, the single largest output decrease in history.

In 2021, oil demand returned as COVID-19 lockdowns eased worldwide, pushing prices higher. Now into 2022, Russia’s aggressive war against Ukraine has sent oil prices skyrocketing.

There are several factors contribute to the fluctuation in global oil prices, including:

It was evident time and time again that fluctuations in oil prices have a significant impact on consumers, as the price of oil is closely tied to the cost of many goods and services. When oil prices rise, the cost of transportation increases, which in turn leads to higher prices for goods that are transported, such as food, clothing, and electronics. This can result in inflation, which erodes the purchasing power of consumers. In specific, the effect of fluctuations in oil prices include:

The fluctuations in oil prices have a direct impact on the inflation rate in Jordan, as the country heavily relies on oil imports. A rise in oil prices affects the balance of payments due to the additional spend on oil imports, which negatively affects the overall economic growth.

A sudden increase or decrease in oil prices can significantly impact Jordan’s economic growth. High oil prices lead to inflation and reduce economic activity, while low oil prices result in lower government revenue triggering slower economic growth. Inflation effects can be detrimental as it increases the cost of transportation, energy, and other goods, which is particularly problematic for developing countries like Jordan where a large portion of the population live within limited means.

In addition to the above, higher oil prices have a direct impact on the cost of transportation, which such costs are passed to the end consumer whether it is through businesses or directly in the households through increased costs of electricity. Furthermore, Jordan agricultural production experiences a negative effect due to the increased cost of production which affects the overall competitiveness of the agricultural sector and decrease the trading and export activity of the Jordanian agricultural products.

The investment climate in Jordan is also affected by oil prices for investors are usually attracted to a country where the cost of doing business is reasonable. An increase in oil prices could add an un-necessary complication to the Jordanian investment climate and cause a loss of investments.

The negative effects of the increase in global oil prices will undoubtedly increase the hardships faced by the Jordanian population and potentially destabilize the country’s political environment due to the limited economic growth and the inability of the Jordanian population to cover the basic life needs.

In is undeniable that the global oil prices have a profound effect on the livelihood of the population in any country including Jordan. However, there is still time for the governments to react and implement certain measures to withstand the down effects of the increased global oil prices.