Foreword

Several factors are driving these trends. Economic uncertainty, influenced by inflation, rising interest rates and the looming risk of a global recession have promoted dealmakers to adopt a more cautious approach to capital allocation. Divesting non-core assets allows organisations to free up resources, enabling them to reinvest in higher-growth areas or bolster their balance sheets in anticipation of potential economic challenges.

Regulatory pressures have also come into play, as governments worldwide impose stricter oversight on cross-border M&A. In response, companies are increasingly divesting foreign assets or restructuring supply chains to minimise dependence on specific markets or regions.

In the US, the world’s largest M&A market, the divestiture trend is particularly robust, as indicated by an international group of dealmakers interviewed as part of the research for this report.

Many are turning to carve-outs as part of their divestment strategies. These transactions, where a parent company separates a business unit to operate independently, are becoming increasingly popular in corporate America as industrial giants look to refocus their efforts and boost shareholder value. As we look ahead, the growing emphasis on divestitures and carve-outs in the US M&A market signals a shift towards more agile and focused organisations.

This trend is likely to have far-reaching implications for the broader business ecosystem, potentially catalysing increased M&A activity, driving sector consolidation and spurring innovation as companies seek to optimise their market positions. For dealmakers and executive decision-makers, understanding and leveraging this divestiture trend will be crucial to navigating the evolving M&A landscape and identifying opportunities for value creation in the years to come.

The insights in this report set out the current trends shaping the US M&A market. It also provides a snapshot of best practices and actionable steps that other dealmakers can follow if they are considering or planning divestitures of their own, providing a valuable roadmap for success.

In today’s economic environment, divestitures have become a crucial strategy for organisations to streamline operations and refocus on core business activities.

By shedding non-core assets, organisations free up cash, simplify operations, unlock shareholder value and position themselves for long-term growth in a dynamic market. Baker Tilly’s corporate finance teams can help organisations successfully navigate the complexities of divestitures, ensuring a clean break while maximising returns and minimising costs.”

Head of Corporate Finance, Baker Tilly International

The divestiture dividend: Dealmakers fuel growth through strategic sell-offs

Out with the old: Recent divestitures score high marks

Operational cost reductions: Half of dealmakers (50%) also said that divestitures helped lower operational expenses. By divesting assets, organisations can streamline their operations, reduce overheads and achieve greater operational efficiency.

Enhanced focus on core activities: 47% of respondents noted that divestitures allowed their organisations to sharpen their focus on core business areas. By divesting, they were able to reallocate more resources and management attention to primary operations, driving innovation and growth in these critical areas. Equally, 33% of respondents say proceeds from recent divestitures were used to reinvest in strategic business areas, the second-greatest use of these funds (Figure 4). “Rather than opt for debt options, we used the proceeds from the divestiture to enhance automation and implementation of the latest technologies in our industry,” says the CEO of an Austrian corporation.

In with the new: M&A and expansion

“We need to improve our portfolios on a regular basis, and usually divestments are considered with the intention to fund new acquisitions,” says the managing director of a PE/VC firm in the US.

The strategic use of divestiture proceeds demonstrates that these transactions are not merely about shedding assets or reducing costs. Rather, they are increasingly viewed as a means of unlocking capital to fund transformative change and drive long-term value creation.

Divestitures are emerging as a vital strategy across sectors like technology, healthcare and industrials, allowing organisations to enhance financial performance and streamline operations. With 63% of dealmakers predicting a significant impact on short-term M&A trends, these strategic sell-offs are particularly reshaping industries where agility and innovation are key.”

CEO, Baker Tilly Spain

US market update: M&A and divestiture trends

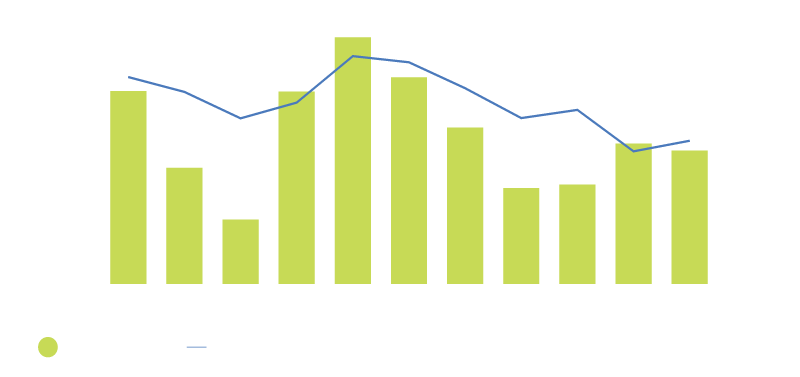

That being said, M&A totals in 1H2024 showed a slight increase compared to the previous half-year (Figure 5). Despite the uptick, overall volumes remain below pre-pandemic levels, although deal values seem to have bounced back to some extent following depressed levels in late 2022 and early 2023.

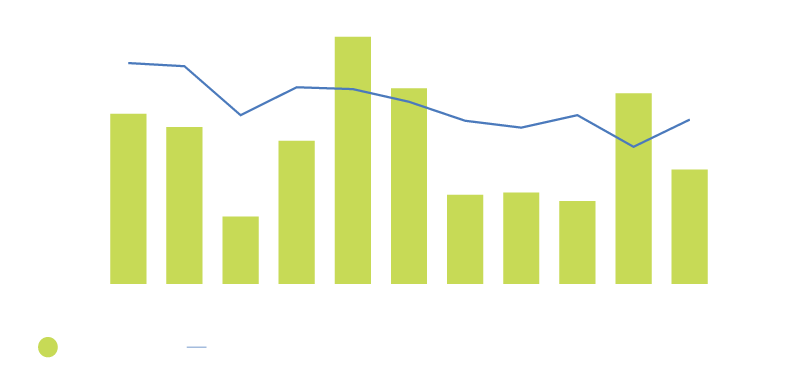

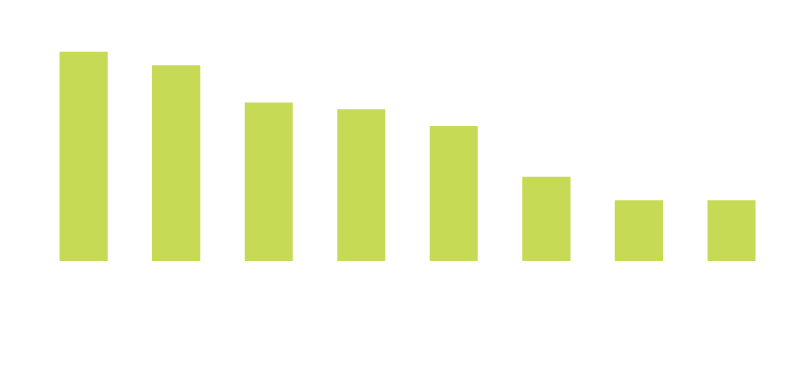

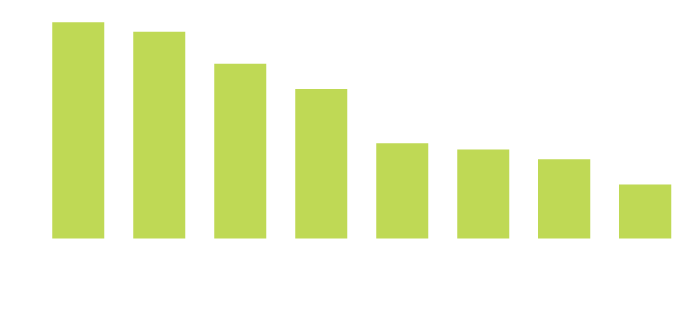

Divestiture activity has followed a similar pattern. Declining divestitures saw a sharp reversal in 1H2024 as companies put greater emphasis on reassessing their portfolios (Figure 6). Increased regulatory scrutiny in industries like technology and healthcare is prompting some companies to divest assets to avoid antitrust issues, while others have been divesting assets as part of their sustainability efforts.

One notable trend in divestitures has been the rise of carve-outs, where companies are selling a subsidiary or division that operates independently of the parent company. Carve-outs have become an attractive option for companies looking to unlock value from non-core assets while retaining some level of ownership or involvement. For example, General Electric’s decision to spin off its healthcare division into a separate company is a prime example of a strategic carve-out aimed at focusing on core industrial operations.

Outlook 2025

Going forward, while the US M&A market is likely to face headwinds in the near term, the fundamental drivers of dealmaking remain intact. Companies will need to be strategic and adaptable in navigating the evolving landscape, balancing growth ambitions with the need to manage risks and regulatory challenges. As such, deal volumes and values are expected to stabilise at more moderate levels, driven by selective acquisitions.

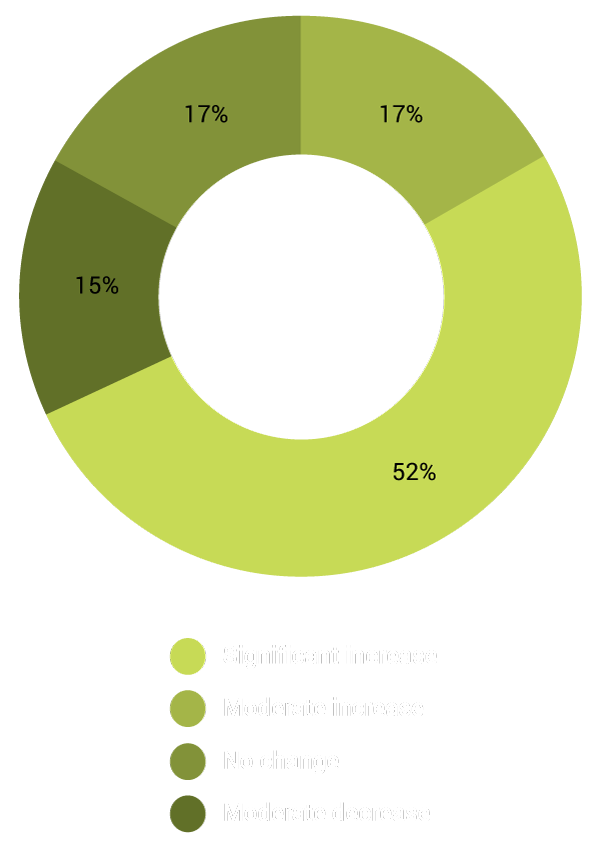

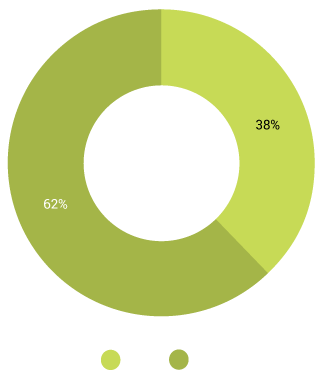

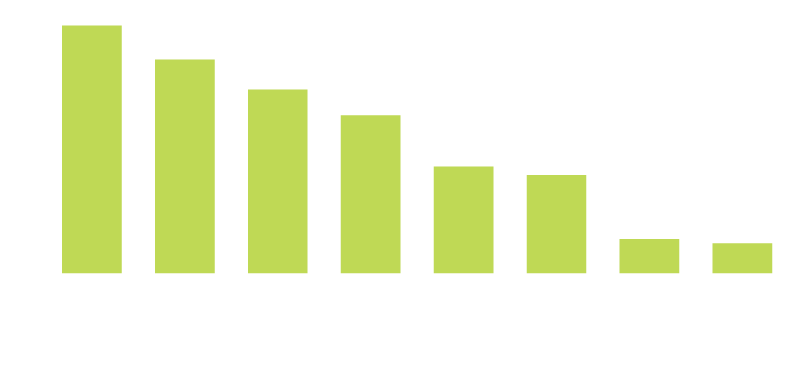

On the divestiture front, asset sales are expected to remain a prominent trend in 2025, as companies continue to optimise their portfolios. Looking ahead, respondent sentiment suggests a potential robust increase in divestitures over the next 12-24 months, with 69% anticipating a rise, particularly in carve-outs (Figure 7). Additionally, the role of activist investors is expected to grow, driving more companies to divest underperforming assets to unlock value.

Ultimately, the pace of divestments will largely depend on broader economic conditions. In a volatile market, companies may accelerate plans to sell assets to raise cash and strengthen balance sheets.

The rise of carve-outs: Advantages and opportunities

Carve-outs have emerged as a powerful tool in dealmaker strategies, offering key advantages over other divestiture methods.

Flexibility in transaction structure

For example, a parent company might choose to retain a minority stake in the carved-out business, allowing it to benefit from future growth. This can be an attractive option when the parent company believes in the long-term potential of the business being divested but wants to reduce its exposure.

Value maximisation

“Value maximisation is one of the main benefits. Divesting fully from the non-core unit can provide a substantial amount of funds within a short amount of time. It allows companies to improve their competitive position,” says the head of strategy at a US corporation.

In the current US M&A landscape, divestitures are not only a means of shedding non-core assets but also a powerful strategy for unlocking capital to fund new investments. With 40% of US dealmakers using divestiture proceeds for acquisitions, companies are rapidly pivoting towards promising markets and technologies. Carve-outs, in particular, are becoming a preferred method, offering flexibility and value maximisation while helping organisations navigate regulatory and operational complexities.”

Principal, Baker Tilly (US)

Risk management

“The risk containment potential is good compared to other divestiture methods. If companies ensure proper legal and compliance methods over time, there are fewer risks and maximised value during the carve-out,” says the head of strategy at a Swedish company.

Divestiture drivers

Technological disruption and digital transformation

This trend is particularly evident in sectors where traditional business models are being upended by automation and digitalisation. In manufacturing, for example, firms are opting to divest legacy production facilities that are ill equipped to handle the demand of a digitally driven market.

Similarly, in retail, divestitures are a growing trend. Impacted by the rise of e-commerce, traditional brick-and-mortar retailers are selling off real estate and other non-core assets to focus on expanding their online presence and enhance their digital capabilities.

Divestitures are increasingly driven by technological disruption, market competition and the need for financial restructuring. As industries adapt to digital transformation and rising ESG expectations, companies are shedding legacy assets to remain competitive and agile. Growing pressure from investors, consumers and regulators is pushing organisations to align with sustainable business practices, making ESG considerations a key factor in divestiture decisions.”

CEO, Baker Tilly Belgium

Market competition and agility

“Market competition increased in several sectors. There’s been significant changes in the strategies employed for building competitive value. Executing divestitures and focusing on new investments have become more important,” says the partner at a US-based PE/VC firm.

Financial restructuring and capital needs

“Financial restructuring decisions are somewhat risky, but delays are not ideal for the continuance of the company. We decided to divest from the asset in order to build a better financial position,” says the chief strategy officer at an Italian company.

Sustainability and environmental, social and governance (ESG)

The big picture: Organisation-wide restructuring

This suggests that dealmakers are adopting a holistic approach to portfolio management, leveraging divestitures as a strategic tool to reshape their organisations for future growth and enhanced competitiveness. By aligning divestitures with broader restructuring efforts, firms can achieve more significant transformational impact and position themselves more effectively in their target markets.

Strategies for success: Maximising value and minimising disruptions

Respondent sentiment provides valuable insights into how dealmakers are planning and executing divestitures. These best practices can help dealmakers navigate the complex process of divestitures more effectively and achieve their strategic objectives.

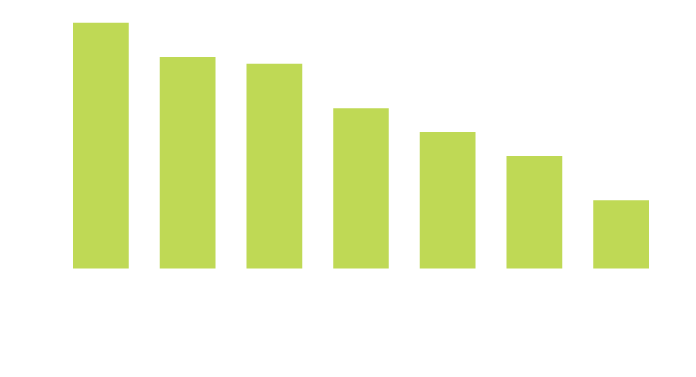

Securing higher valuations

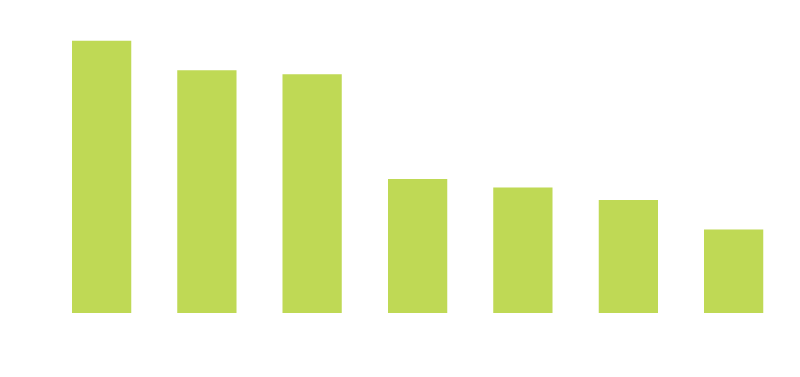

One of the most critical aspects of a successful divestiture is maximising the valuation of the divested asset. Among the strategies respondents have turned to, the most prominent, cited by 62% of respondents, involved providing clear and transparent financials (Figure 11). Transparent financial reporting builds trust and reduces perceived risks, making the asset more attractive to buyers.

Equally, potential buyers are more likely to offer a higher price when they have a thorough understanding of the financial health and performance of the business being sold.

Effective marketing is another critical factor (according to 57%). By highlighting the strengths, growth potential and unique selling points of the business unit, companies can generate greater interest and competitive bidding among potential buyers. A well-executed marketing campaign can significantly enhance the perceived value of the asset.

Investing in new technology prior to the sale was another key action to boost valuation, according to 55% of respondents. Upgrading technology can improve operational efficiency, reduce costs and demonstrate the asset’s readiness for future growth. This investment not only enhances the immediate appeal of the business but also positions it as a forward-thinking and innovative entity – thereby commanding a higher price.

According to a partner at a US-based PE/VC firm, “I feel that investing in technology and innovation can really drive up the value of business units. It’s about making the company appear to be future-focused, and technology alone can make this happen.”

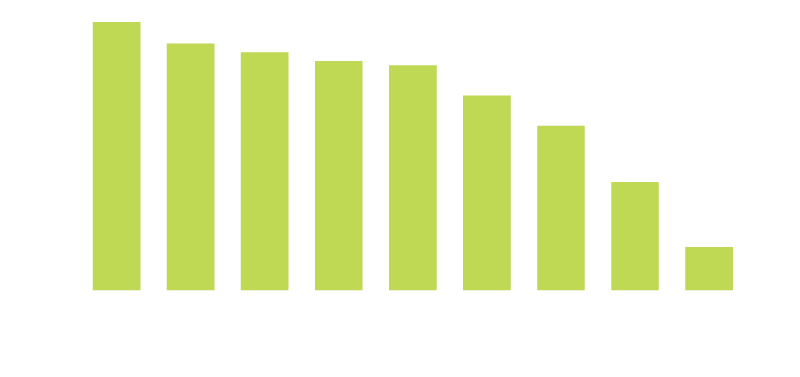

Managing the transition

Conducting risk assessments is a critical step when managing the transition of the asset from seller to buyer – 72% of respondents say they engaged in this practice to manage potential challenges (Figure 12). Identifying and addressing risks proactively helps develop contingency plans and ensures that the divestiture process proceeds without major disruptions.

Change management strategies have also been vital, as indicated by 62% of respondents. Divestitures can cause uncertainty and anxiety among employees, customers and stakeholders. By addressing concerns and maintaining morale, companies can ensure a smoother transition and sustain productivity during the divestiture process.

60% of respondents emphasised the importance of conducting joint planning sessions with buyers. Close collaboration facilitates a deeper understanding of each party’s expectations, timelines and integration plans. This approach fosters a positive relationship and can ultimately contribute to the success of the divestiture.

Key challenges and opportunities for improvement

Divestitures are complex and challenging undertakings that demand meticulous planning, execution and communication.

So, where are dealmakers facing the most challenges when completing divestitures, and how do they intend to adjust their strategies for future transactions?

Negotiations

For these reasons and others, 50% of respondents say that they would take different steps during future negotiations (Figure 14). Many recognise that effective negotiation is central to securing favourable deal terms. This could involve adopting more flexible tactics, engaging with multiple potential buyers or involving third-party advisers to provide objective perspectives.

Employee transition management

Maximising the valuation of divested assets is essential for dealmakers, with transparent financial reporting, effective marketing and investing in technology identified as key strategies. Clear financials reduce risk and attract higher bids, while showcasing the asset’s growth potential through strategic marketing boosts buyer interest. By investing in new technology, companies can demonstrate innovation and position the asset for future success, ultimately commanding a higher price.”

Partner, Pitcher Partners

Valuations

Regulatory challenges

Regulatory approvals were cited by 47% of respondents as a major obstacle. Securing these approvals can prove a major hurdle, often involving a time-consuming and uncertain process. Delays in obtaining the necessary approvals can derail timelines, increase costs and in some cases, even result in the abandonment of the deal.

Lessons learned and future strategies

Moving faster to capture value. One of the most frequently mentioned lessons was the importance of speed in completing the divestiture (according to 58% in Figure 14). As the partner at a Swedish PE/VC firm illustrates, “I would have focused on faster execution. The process was not organised. The due diligence process took much longer than we expected, and the negotiations were also more time-consuming than usual.”

Enhancing stakeholder communications. 43% of respondents say they would have improved communications with stakeholders. Transparent and timely communication is critical to managing expectations and maintaining trust throughout the process. Clear communication can mitigate the uncertainty that often accompanies divestitures and helps ensure a smoother transition for all parties involved.